Uncover the True Financial Picture

Divorce often involves far more than just splitting a house and a bank account. CDFAs® are trained to identify all marital assets, including retirement accounts, pensions, stock options, business interests, and even hidden or overlooked assets like deferred compensation or executive benefits. They can also clarify liabilities like joint debts, mortgages, or tax obligations. This ensures you walk into negotiations fully informed, so nothing is missed or misunderstood.

Importance of a CFDA®

Forecast Long-Term Financial Outcomes

What may seem like an equal division on paper today might look very different in 5, 10, or 20 years. A CDFA® uses financial modeling tools to simulate how different settlement scenarios will play out over time, considering inflation, taxes, investment growth, and lifestyle costs. This helps you choose a path that supports your long-term financial security - not just short-term needs. For example, choosing between a lump-sum payout or keeping the marital home has very different financial implications over time, and a CDFA® can walk you through those trade-offs with clarity.

Navigate Divorce-Specific Tax and Legal Complexities

CDFAs® are highly knowledgeable in the tax implications of divorce. They’ll help you understand how the division of assets, alimony (spousal support), retirement account withdrawals, and property sales may trigger taxes or penalties - so you don’t make costly mistakes. For example, dividing a 401(k) incorrectly without a QDRO (Qualified Domestic Relations Order) can result in penalties and tax consequences. They work hand-in-hand with attorneys to ensure the financial components of your settlement are structured legally and tax-efficiently.

Design a Practical and Strategic Settlement

CDFAs® help you create a realistic post-divorce budget and assess whether proposed settlements are sustainable. They analyze expenses like housing, healthcare, education, and lifestyle needs - and compare them with available income and assets. This kind of strategic thinking helps ensure you’re not left with a settlement that’s “fair” on paper but unaffordable in reality. They can also advise on asset liquidity, helping you avoid scenarios where you’re "house-rich but cash-poor."

Strengthen Legal Negotiations with Data-Backed Insights

Attorneys focus on the legal aspects of divorce; CDFAs® complement them by bringing in financial precision. They prepare reports and visuals that can be used in mediation or court to support your position. Whether it's showing the long-term costs of accepting one asset over another or clarifying child support affordability, their insights make a compelling, fact-based case that can lead to faster, more equitable outcomes - often reducing overall legal fees and time in court.

Protect Against Emotion-Driven Financial Mistakes

Divorce is emotionally exhausting, and financial decisions made in anger, fear, or guilt can lead to long-term harm. A CDFA® provides a neutral, professional perspective, helping you slow down, process clearly, and make decisions rooted in logic - not emotion. Whether you’re tempted to keep the house at all costs or rush into risky investments to “make up for lost time,” a CDFA® serves as your financial voice of reason.

MEET THE FOUNDER & CEO

Judd Allen

Choosing Judd Allen as your Certified Divorce Financial Analyst (CDFA®) means working with a knowledgeable, strategic, and compassionate professional who understands the financial complexities of divorce. With a deep background in wealth planning and transition support, Judd helps clients gain clarity on their assets, avoid costly financial missteps, and build a stable foundation for the future. He brings a clear, personalized approach to each case - whether it involves dividing retirement accounts, managing alimony, or planning for long-term financial independence. As a fiduciary, Judd is committed to putting your best interests first, guiding you through the financial side of divorce with confidence and care.

Focused Expertise: Delivers customized planning for professionals in Financial management.

Client-Centric Philosophy: Prioritizes client's personal goals - especially meaningful milestones like a secure retirement.

Innovative Approach: Embraces technology and ongoing professional development to stay current and strategic.

Let's Connect!

Ready to take the helm of your financial voyage?

With seasoned insight tailored to the Auto Industry, I’m here to navigate through your financial concerns. Let’s chart a course towards your secure and prosperous future together.

Your journey towards financial resilience starts here!

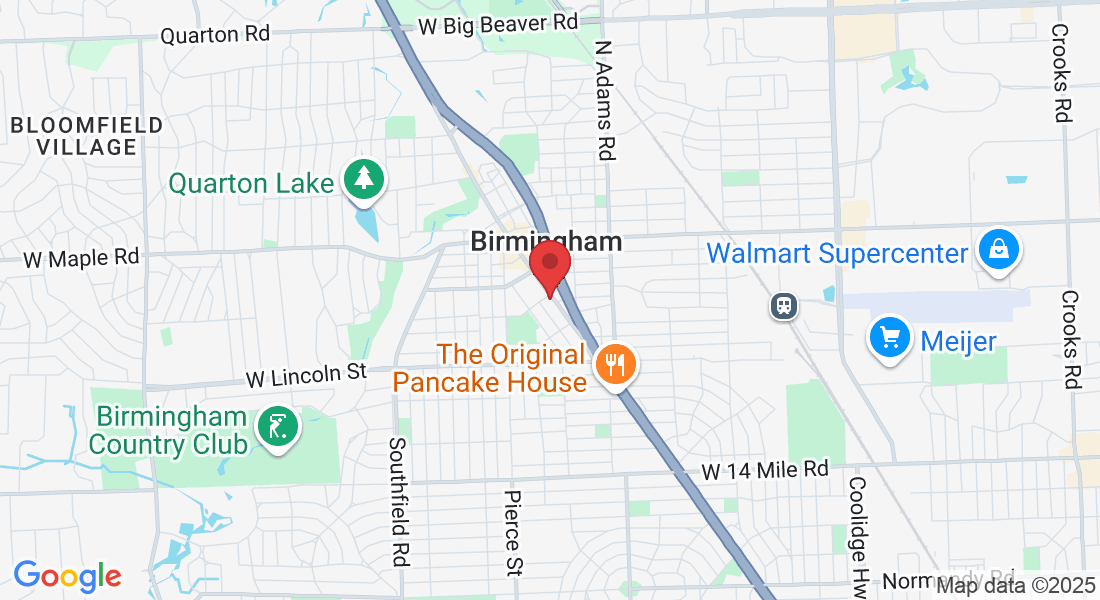

248-273-8200

© 2023 by J. Allen Financial

Osaic Form CRS

Check the background of your financial professional on FINRA's BrokerCheck.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information.

Securities and investment advisory services offered through Osaic Wealth, Inc. member FINRA/SIPC. Osaic Wealth is separately owned and other entities and/or marketing names, products or services referenced here are independent of Osaic Wealth.

Third Party Site Disclosure: The information being provided is strictly as a courtesy. When you link to any of the websites provided here, you are leaving this website. We make no representation as to the completeness or accuracy of information provided at these websites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, websites, information and programs made available through this website. When you access one of these websites, you are leaving our website and assume total responsibility and risk for your use of the websites you are linking to.

This communication is strictly intended for individuals residing in the states of Arizona, California, Colorado, Florida, Iowa, Idaho, Illinois, Indiana, Louisiana, Michigan, North Carolina, Ohio, Tennessee. No offers may be made or accepted from any resident outside the specific state(s) referenced.